What Are Some New CPF Changes For 2022

- acareerpursuit

- Mar 4, 2022

- 3 min read

When it comes to being a Singaporean, there is one thing that everyone needs to know – CPF.

CPF has been well integrated into our lives with the acronym being used everywhere, literally. Be it at work, in the hospital and on the news. But many would not know that CPF makes regular amendments to adjust to our cost of living as well as meeting different needs of every Singaporeans.

We all know the importance of understanding our CPF so as to maximize it to our benefits but also how confusing it can be sometimes right?

No worries! Let’s understand some of the new changes in this article!

Objective of 2022 New changes

Let’s start off with the objectives for the new changes. Why the need for changes when we have no new objectives right?

So for 2022’s changes, here are the objectives from CPF.

Helping members build up Retirement Savings

Ease of Receiving Retirement Payouts

So now that we know the objective for the new changes, let’s see what some of the changes are!!

Hmmm… What are some of the new changes?

Increase in CPF Contribution Rate

For those of you that are unaware, once you are employed, your employer and you will have to contribute a certain percentage of your monthly income into your CPF account.

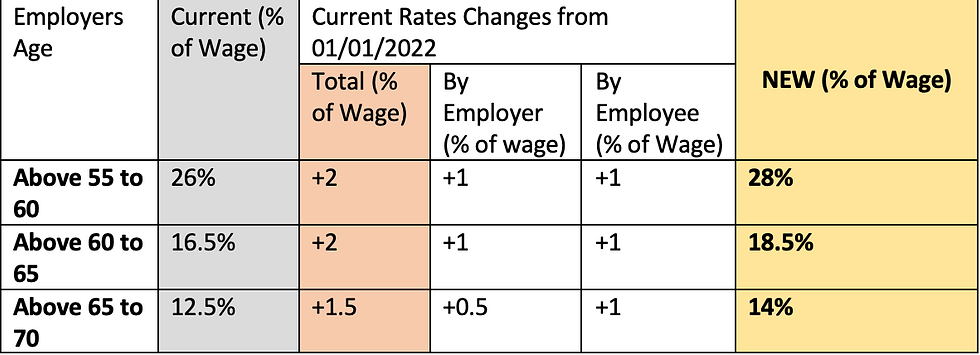

With effect from 1st January 2022, there will be an additional 1.5% to 2% overall contribution to your CPF every month.

Here is the revised Contribution rate from CPF Website

Do note that changes are only for employees that are aged 55 and above, this helps them boost up their retirement savings especially when they already have a separate Retirement Account (RA) opened.

Increased Tax Relief for Voluntary Contributions

“It’s a Win-Win Situation! Killing 2 birds with 1 stone”

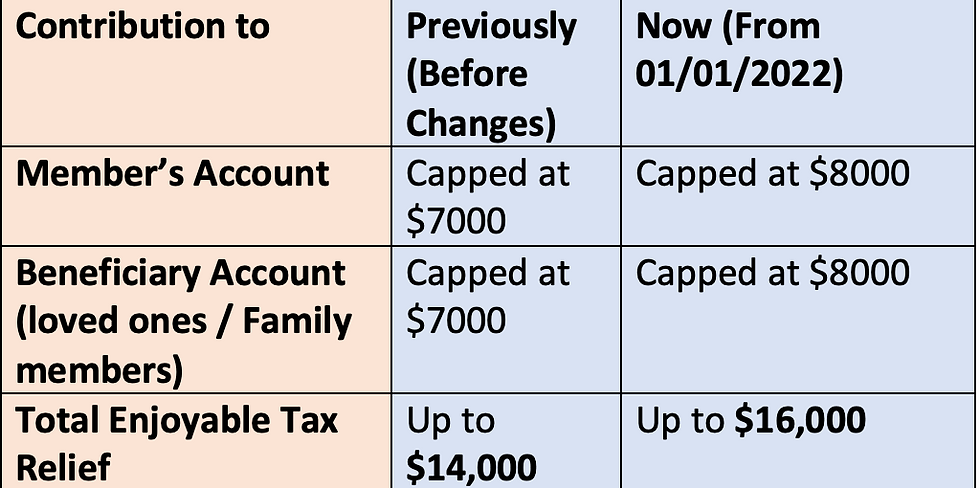

With the new changes, members can also enjoy an increased tax relief of up to $8000 when top up to their personal Special / Retirement or Medisave Account.

In addition, members also get an additional tax relief of $8000 when contributions are made to their loved ones (family members).

That will be a total of $16,000 worth of tax relief and also for a better future of building up long term retirement savings!

All inflow into RA will be give an increase in CPF Life Payouts

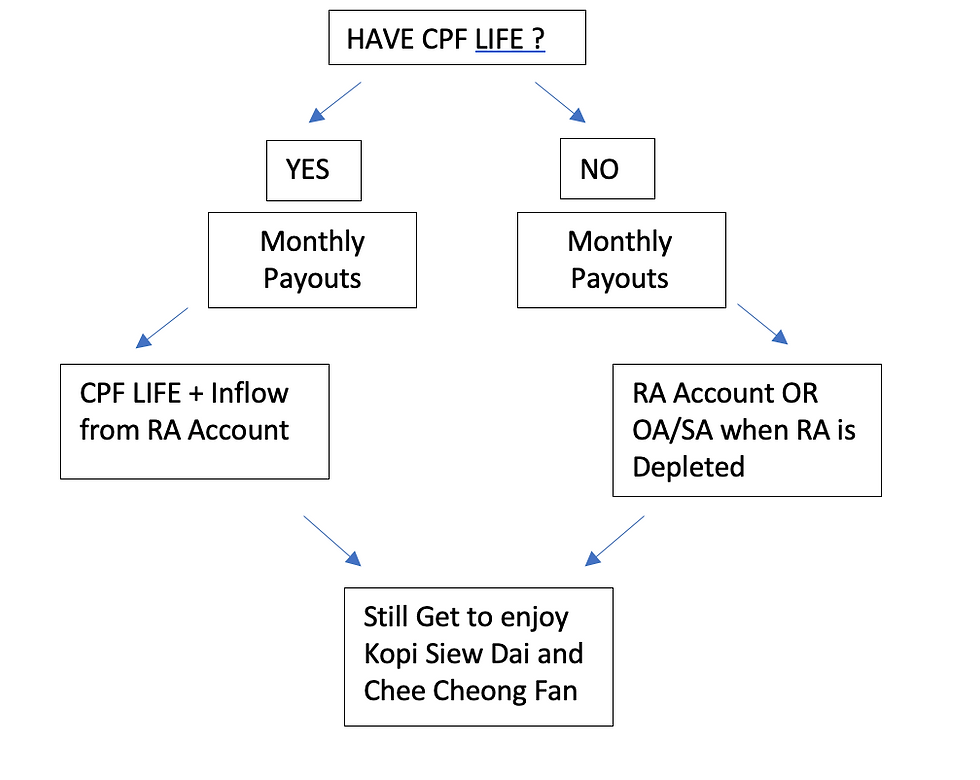

With this new change, any subsequent inflow of cash into their Retirement Account (RA) will be automatically given as payouts with CPF Life’s payouts.

This change will allow members to receive more at the end of each month under the CPF Life scheme. YAY!! More money for our ah gong and ah ma to buy their favorite Kopi Siew Dai and Chee Cheong Fan!

For members not under CPF Life, they can withdraw from OA/SA when Retirement Sum is depleted.

We may have heard about the CPF Life scheme, but not everyone may have enrolled into this scheme. For those that never did, they can only rely on their Retirement account for monthly payouts.

Under this new change, members who finish off what they have in their retirement account will receive automatic transfer from their Ordinary and Special Account to their Retirement Account so to receive monthly payouts again.

This will greatly help those that may still be employed at an old age and still receiving contributions into their OA and SA at the end of every month.

So What Now Ah

“HUH Why So Chim”

So here you go, these are some of the important changes that CPF have made for the better of all of us. We know this can be really overwhelming and “Chim” for some of you.

However, it pays to know these changes to maximize our CPF accounts to our advantage.

Given that CPF plays a huge part of our life as well as when planning for our retirement, it is important for us to understand how it works and the ways that we can tap on the resources that are available to us.

If you wish to further look into ways you can maximize your savings in your CPF, feel free to Chat With Us to find out how. There may be a few savings tips as well as benefits we can work around for our CPF accounts !

C x D

Learning about financial literacy can also be fun and easy ! Stay with us in this financial journey one post at a time to find out how ! If you haven’t already, you can check out our other work down below too, happy learning and reading

Hmm.. Should I be Saving or Investing?

Comments